Prerequisites - You will need a QuickBooks Online (QBO) account.

Terminology Mapping

Before talking about how to install the integration it's worth noting some terminology used by QBO and how that is translated to Obit.

| Obit | QBO |

| Client | Customer |

| Nominal Code | Account |

| Orders | Item |

| Company | Class |

To install the integration you need to

- Go to the Admin Area -> Integrations

- Click on "Connect to Quickbooks"

- Sign in to your QBO account (you may need to provide a 2FA security code)

- Select which company to connect (if you have multiple companies under your account).

- Authorise Obit to connect to your company.

Configuring the Integration

To get your QBO integration working correctly we need to first configure it.

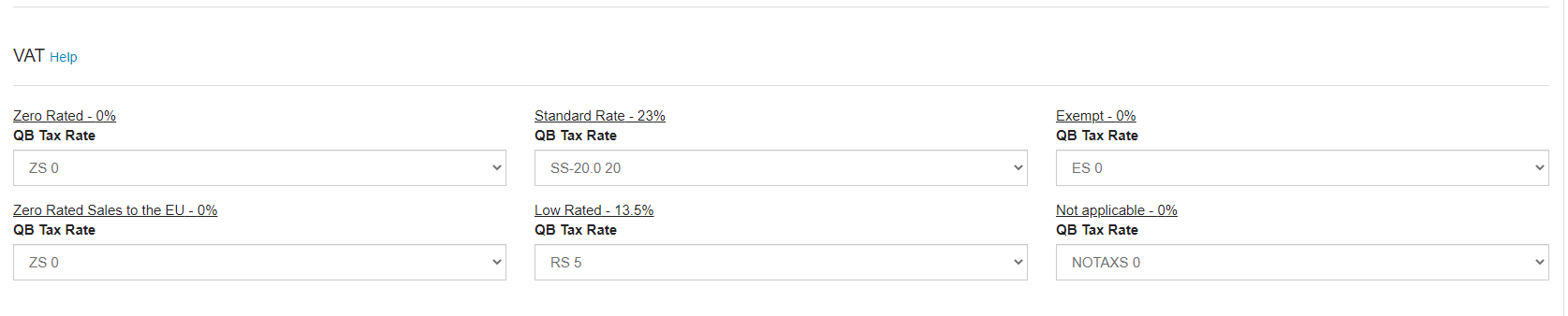

VAT

You should map each of the VAT rates in Obit to it's corresponding rate in QBO.

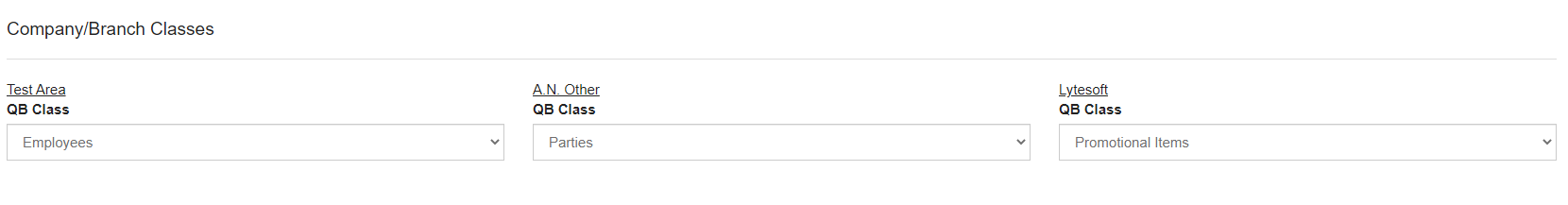

Branch Setup

Each one of your branches or companies can be associated with a Class in QBO so you can filter activity from one branch from the other. You will need to create your own classes in QBO before they appear here and can be associated.

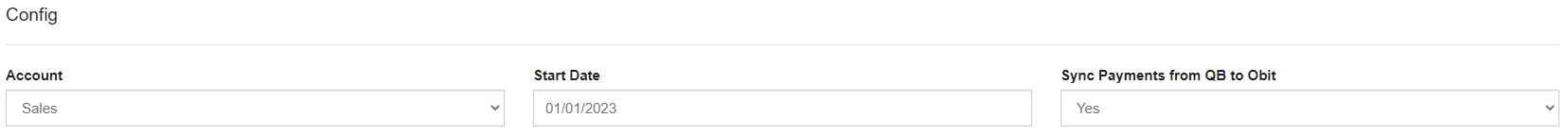

Configuration

| Account | This is the account that Obit will assign the orders to when there is no specific nominal code set in an item. If you do not want to set nominal codes for each item then setting this to your sales account should be sufficient. |

| Start Date | From what date forward will we start synchronising your invoices & credit notes to QBO. This is based on the date the invoice or credit note is created. |

| Sync Payments | If selected, Obit will start receiving notifications about new, modified or deleted payments in QBO and try to reflect that in Obit. |

How does the synchronisation to QBO work?

The flow of events look like this:

- Every half hour Obit will look for any unexported invoices or credit notes (either Finalised or Cancelled) with a creation date after the date set in the integration configuration.

- We will check if a customer exists with the Suffix set to the Funeral Account Reference in Obit. For example, if the funeral reference is set to MW-20221125 we would look in QBO to find a customer with the same suffix.

- If we don't find a matching customer we will create it, again setting the Suffix to be the funeral reference. So you might have a new customer created, Mark White (suffix: MW-20221125).

- We will review all the orders in the invoice or credit note you are exporting and ensure we can match their nominal codes to a corresponding Account in QBO. If not we will create them. You may for example have 4300: Coffin as a nominal code.

- Next we look at all the orders in the invoice or credit note to see if the items themselves exist in QBO. If not we will create these.

- Next we will synchronise the actual invoice or credit note.

What about Payment synchronisation?

- When a payment is created, updated or deleted in QB it sends a message to Obit with the transaction Id and type of operation.

- Based on the type of operation we perform the following

- Remove: If a payment has been removed we try to find the related payment in Obit and if we do we remove it as well.

- Update: We search for the transaction by the id and if it exists we will also update it's amount.

- Create: We will create a new transaction with a 'pending verification' flag if we do not find a matching payment already in Obit (this is to avoid the possibility of duplicates appearing).

How to check if an invoice or credit note have synchronised?

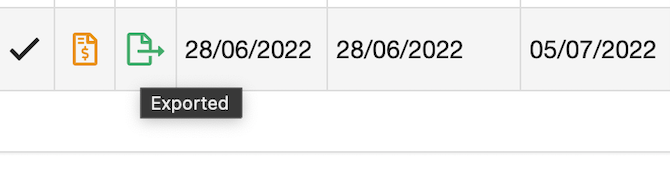

If it has synchronised correctly you will see a green icon beside the financial record in question.

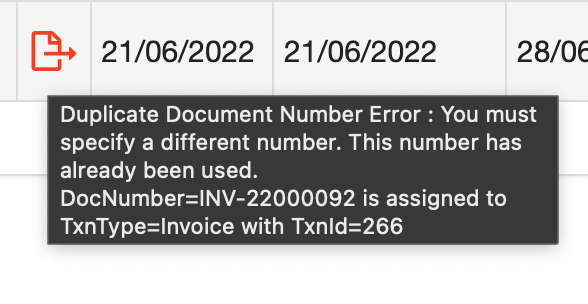

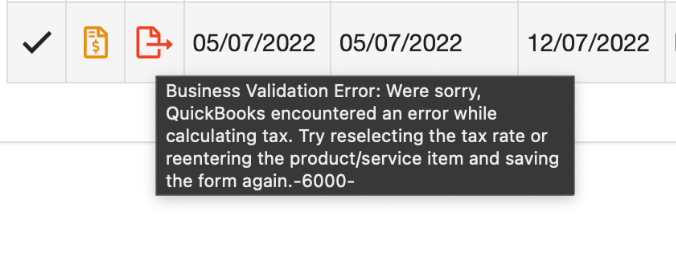

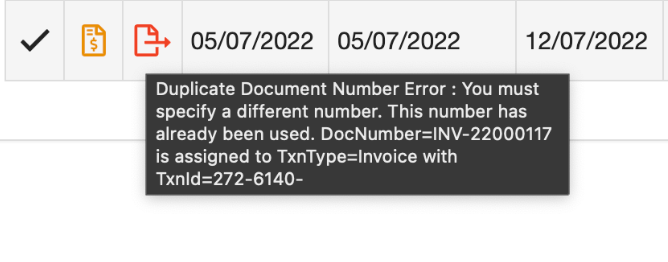

If the synchronisation fails you will see a red icon and hovering over the icon will show you the error.

Fixing Common Errors

The following error occurs when some charges in a financial record don’t have necessary info regarding tax. Make sure all your charges have tax code and retry the export.

The following error occurs when you already have an existing invoice in QB with the same invoice number. This may happen if you had already been exporting to QB via another means before installing the integration. If the invoice is in fact a different invoice but just with the same number you could cancel it with a credit note and create a new one which will get a new invoice number.